Loan capacity

How much real estate loan can I afford?

Your real estate acquisition budget depends cumulatively on your borrowing capacity and your down payment. In this article, you will gain an extended understanding on which criteria are commonly used by banks to evaluate your borrowing capacity and how FIDEM independently assist you understanding what means for your household and your life’s projects.

Analyze credit capacity

The main added value of a borrowing capacity meeting with fidem. is our match making expertise to combine your home financing needs, your financial situation and your personal expectations. Over one meeting, online or face-to-face, our experts can inform you about your mortgage loan capacity.

Analyze credit capacity

The main added value of a borrowing capacity meeting with fidem is our match making expertise to combine your home financing needs, your financial situation and your personal expectations. Over one meeting, online or face-to-face, our experts can inform you about your mortgage loan capacity.

Important criteria

The most important criteria that have an impact on your monthly capacity:

Personal situation

- Number of borrowers, on your own you go faster, as a team you can go further.

- Age of the borrowers, it sets thresholds on your loan duration.

- Number and age of children and dependent relatives in the household, it sets your protected income.

Professional situation

- employment profile

- professional experience

- public pension contribution, it clarifies the stability of your future incomes to identify your most suitable loan duration.

- Education, banks like to know you better.

Financial situation

- Total of monthly net recurring incomes, it sets a theoretical monthly repayment capacity.

- Existing financial obligations, it reduces your theoretical monthly repayment capacity.

- Savings for your down payment define your borrower’s capacity.

- Wished instalment, it is important to know how much you are ready to pay a monthly basis over the duration of your loan contract.

Real estate project

- Valuation according to its location, living surface, construction year and latest renovations.

- Energy performance certificate level, higher the performance, lower the monthly charges.

- Usage of the asset, main residence, secondary residence, or rental object

How does fidem. asses your mortgage loan borrowing capacity?

What defines my maximum instalment capacity?

Incomes

Your income defines your maximum possible credit instalment. It is the starting point for the analysis of your credit capacity. The sum of the loan instalments cannot exceed 50% of your sustainable monthly net income of the household.

This 50% limit is a common practice for which some banks apply alternative approaches. As it depends on several factors how the income is assessed, you should ask fidem. about the individual applicability to your personal profile.

Sustainable incomes over your loan duration

Banks must apply different weightings to your incomes depending on its consistency and its source. For example, fixed monthly salaries are weighted differently than income from self-employment or rental incomes.

Incomes from rented real estate assets, financial investments, state child support & perceived alimonies benefits, and public aids, could be considered, depending on banks assessment, the origin of the income, and the paying counterpart.

The same logic applies when checking the consistency of your incomes. Banks have to assess any potential risk related to your professional situation, e.g. if you are under temporary contract or trial period, if you are self-employed, long-term employed or a civil servant. Your sector of activity, your potential reemployment, and finally your level of education with its potential future outcomes are also considered during this assessment process.

Moreover, if a part of your monthly income includes a variable remuneration based on e.g. commissions or overtime, it could be excluded from your monthly recurring net income for your capacity calculation. The bank key criteria minimizing this correction is the stability of the variable part of this income based on either contractual terms (fixed or performance based), or its recurrence over time.

Variable salary amount and stock option plan value can have a marginal effect on a repayment capacity, and a strong leverage on your mortgage loan application.

Income weighting

The following table provides information on how high banks on average weight the different types of income in the calculation of your sustainable income.

| Source of Income | Weighting |

|---|---|

| Net salary | 100% |

| Rental income | 75% |

| Liberal professions | 50% |

| Self-employed | 50% |

| Variable salary | 0% |

| Lunch & car allowance | 0% |

| Performance bonus | 0% |

| Stock option plan | 0% |

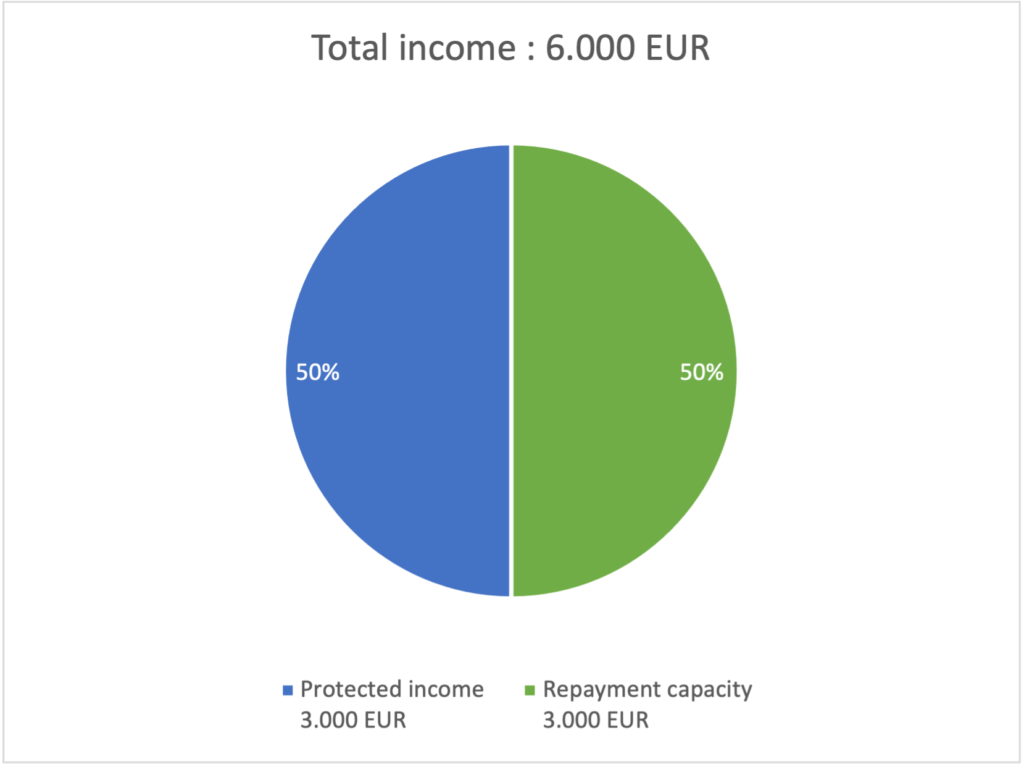

The aggregated recurring incomes are then accounted at 50% to establish your monthly repayment capacity.

Sample calculations for the credit capacity

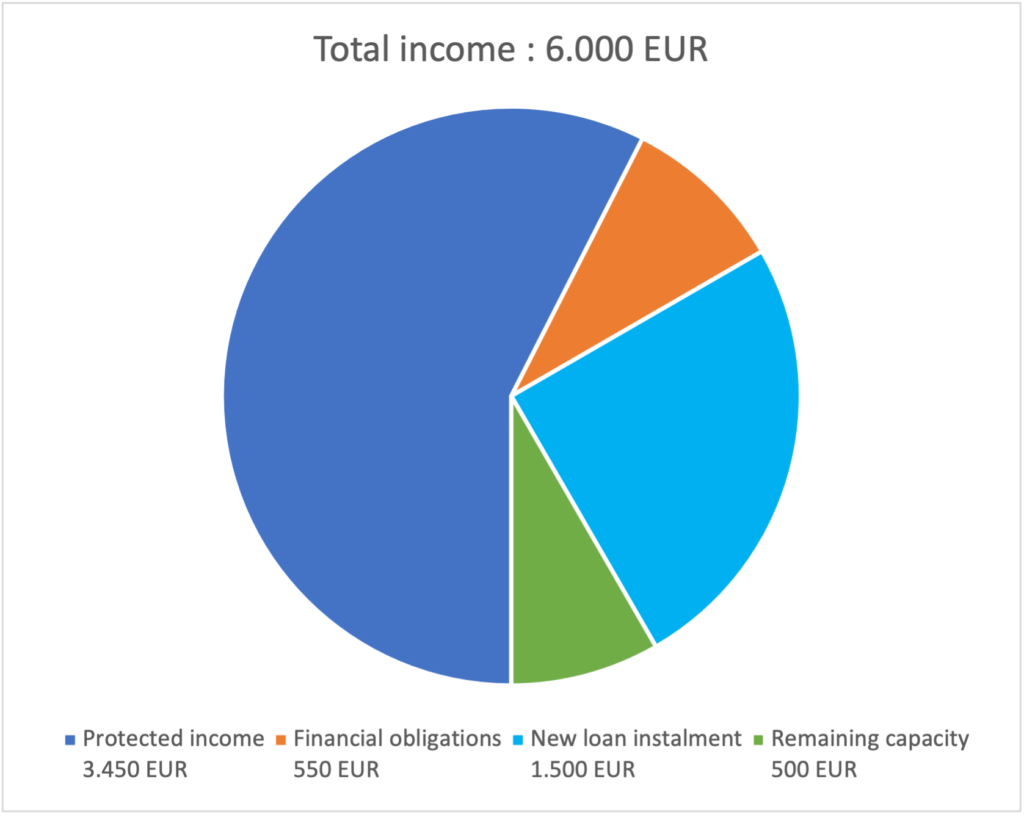

For instance, Mrs A & Mr B jointly earns each month a total net income of 6.000 EUR from their employment contracts. Thus, their maximum instalment capacity, according to this general principle, is 3.000 EUR a month (50% of 6.000 EUR).

To calculate Mrs A & Mr B maximum instalment capacity, we combine the monthly capacity or their wished instalment with the maximum applicable loan duration.

Considering the actual market interest rates at the time of our meeting, we can provide a safe estimate of the maximum borrowing capacity, and the minimum required down payment.

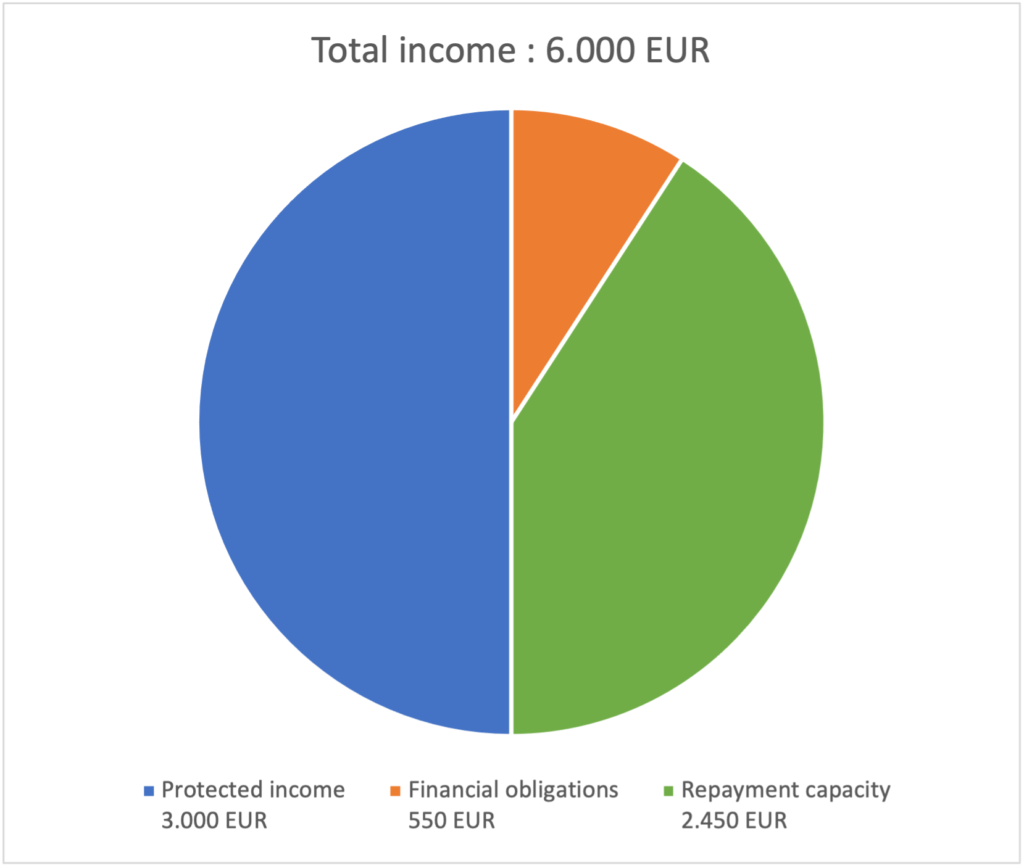

Incomes vs financial obligations

If your household has existing financial obligations, would it be jointly or separately, it will reduce the maximum instalment capacity.

For instance, if Mrs A. has a financial obligation for a car loan of 300 EUR a month, and Mr. B has a financial obligation for a student loan of 250 EUR a month, their maximum instalment capacity will be reduced accordingly.

Due to the existing loan obligations totalling 550 EUR, the remaining capacity for any new loan repayment is only 2.450 EUR (3.000 EUR as total Capacity – 550 EUR of existing monthly instalments).

If any of these financial obligations is related to a credit exposed to variable interest rates or to a fixed revisable interest rate, the instalment capacity assessment will include a stress-test.

An interest rate stress-test considers the risk of a future higher instalment due to a higher interest rate on the existing loan contract.

| Theoretical monthly repayment capacity (50% principle) | 3.000 EUR |

| - existing financial obligations | - 500€ |

| Remaining monthly repayment capacity | 2.450 EUR |

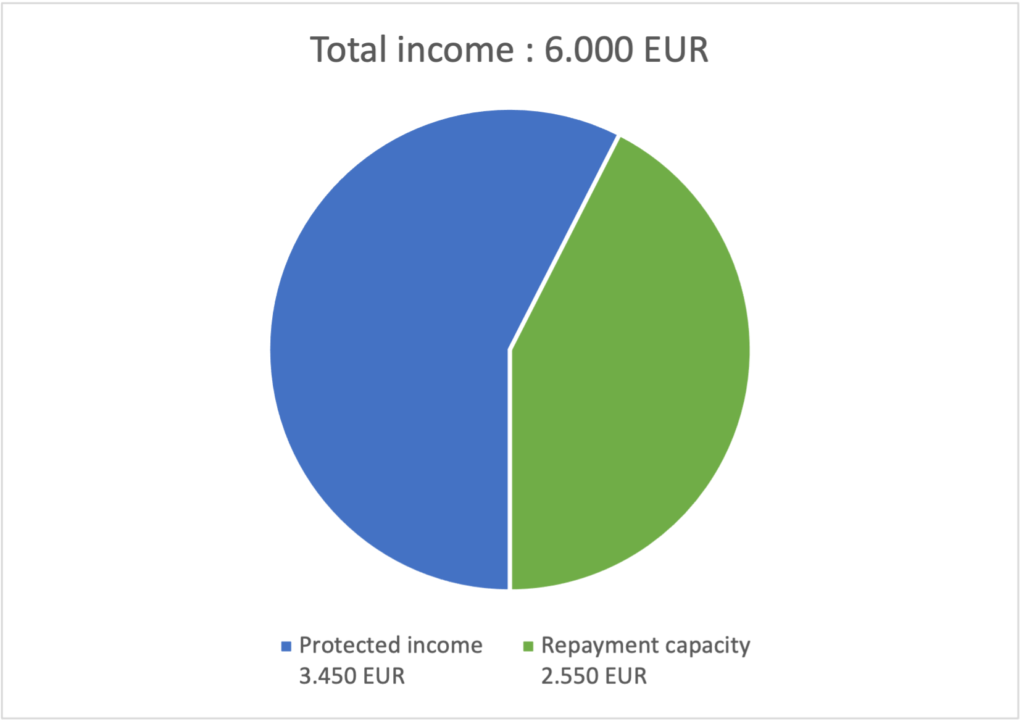

Protected income “Reste-à-vivre minimum”

Once your instalment capacity has been calculated based on your financial situation, we will control if it does not conflict with the legal definition of your “Reste-à-vivre minimum”. This threshold amount defines the part of the household income that cannot be exposed to any financial obligation repayment. The legal term is also known as your “Protected income”.

Its calculation depends on the number of adults and children depending on the household incomes. The protected amounts are respectively a minimum of 1.200 EUR for a single person, 1.450 EUR for a couple, and 300 EUR per child.

| Household | Protected income |

|---|---|

| Single | 1.200 EUR < 1.800 EUR |

| Couple | 1.450 EUR < 2.400 EUR |

| Per child | 300 EUR < 350 EUR |

Since the protected income sets the financial needs for a family with 3 children at 3.450 EUR, then only 2.550 EUR can be exposed to any loan repayment instead of 3.000 EUR, regardless of the 50% limit principle. In this example, the simulation is calculated on the higher protected income references.

As for the other variables, each bank has its own evaluation rules to calculate the applicable “Reste-à-vivre minimum”. Thus, it may vary from bank to bank, and according to the ages of their children. This threshold may be potentially lowered if borrowers have a higher down payment or a guarantor providing complimentary assets as a second guarantee. Banks generally does not accept guarantors when there is a repayment capacity issue.

What defines my maximum borrowing capacity?

The criteria defining your maximum borrowing capacity are your maximum mortgage loan duration combined with your established capacity maximum instalment capacity, the applicable interest rates, and your down payment.

Maximum loan duration

The common rule of your loan duration is 30 years. By default, it is estimated based the number of remaining years till the first of the borrowers reaches the legal pension age of 65 years old.

If Mrs. A & Mr B are respectively of 35 y.o. and 40 y.o., the standard loan duration is 25 years. Banks can reconsider the duration based on:

- A significant difference in salary between the borrowers, e.g., if Ms. A’s net salary is sufficient to cover the loan instalments alone.

- Working profiles, e.g. liberal professions (lawyers, doctors, etc.) tend to work over the legal pension age.

- New residents qualifying as first-time buyers could benefit of a longer duration depending on their level of professional expertise.

- Any existing contribution to state pension (CNAP) is higher than 5 full-time years.

- Any existing assets, either as income (for example, rental income) or as assets (for example, life insurance to cover any remaining debt at retirement).

These examples are the most common factors leading to a loan duration re-assessment based on our credit request submitted on your behalf. As each bank has its own age assessment policy, we already have experience in matching the most suitable financial products for your home financing.

These rules are mainly applicable for the acquisition of a main residence. If Mrs. A & Mr B are planning to invest in a rental object, they should first consult fidem. so as to know their effective maximum loan duration.

How much credit can I obtain with my capacity?

If you want to know how much home financing you can obtain with your calculated monthly installment capacity over the maximum duration, use our loan amount calculator.

Based on your maximum or wished instalment, you can simulate your loan amount that you could obtain from banks with a set interest rate and duration. To get the most accurate loan amount possible, you should also consider the current interest rate situation.

Since the market interest rate is only an indication, it is important to know what other factors influence the interest rate applicable to your individual case. The interest rate is the sum of the risk that the bank takes with the loan. Many factors such as the down payment, the loan duration, the professional profile, the available income, and the value of the property will influence the interest rate offered by the banks. Therefore, it also influences the maximum loan budget.

We will assist you to better assess your personal situation and share our professional expertise regarding which interest rate you can expect for your mortgage loan application.

If you already have a defined real estate project and estimated how much credit you need, you can also use our installment calculator. It calculates your monthly repayment for a set loan amount. Try it out right away!

Instalment and impact on household finances

Once the new loan instalment has been included within the total household incomes with the existing financial obligations and respectfully to the applicable protected income, it is important to verify if the remaining capacity matches your financial expectations for your life projects.

This remaining capacity would be necessary if you are planning to take out any other loan, e.g. car loan, personal loan, or student loan.

After your down payment cash out, it also matters to estimate the recurring amount to reinforce your savings e.g. to buffer any unexpected expenses, and investments positions.

This is also the right time to open a building savings contract. The building savings contract can help to cover expected renovation and modernization work. On the one hand, because you save new equity, on the other hand, because you secure a low interest building society loan. Furthermore, you may be able to claim the savings contributions against tax. The right building savings contract also helps you secure your mortgage loan. If you do not have fixed financing for the entire term of your real estate financing, you can reduce or even eliminate the risk of rising interest rates.

What to expect from my loan capacity meeting with fidem. ?

After your meeting with fidem., you will be familiar with the loan that you wish for. Once combined with the part of your savings that you are ready to invest as down payment, you will know your ideal acquisition budget, including the related acquisition fees. And the most important part is the potential impact of your new loan instalment on your household finances. On the way, we will explain you the next steps and the usual timeline of a loan application processing till the notary deeds.

When is the right time to meet with fidem. ?

Before any real estate project research

If you are thinking about buying a property, it is the right time to familiarize yourself with the realities. What interest rates can I expect? What term and rate fits my goals and desires? How much can I afford? We will answer all these questions before you make your final decision. And it is free of charge and without any obligation.

During your active property scouting

If you are already looking for a new property, it is time to contact us. We will keep you up to date with the latest market developments. We will prepare your loan application so that we can act as soon as you find the right property. With this approach, you do not lose any time on the way to your dream property. We can provide you with a buyer’s certificate, which underlines your financial capacities and gives you an advantage over other prospective buyers.

At the time of your future home sales agreement signature

If not already done at an earlier stage, we will prepare your credit application. We advise you on all relevant points and we assist you throughout the loan application process. We make you aware of how you should structure your loan to remain the most flexible. In doing so, we make sure that you are well informed of any exposure to interest rate risks. We tell you what documents are needed for your individual case to present the loan dossier in the best possible way to the bank and then do what we do best, negotiate your case to obtain the best possible conditions on your behalf.

What to expect from my loan capacity meeting with fidem. ?

After your meeting with FIDEM, you will be familiar with the loan that you wish for. Once combined with the part of your savings that you are ready to invest as down payment, you will know your ideal acquisition budget, including the related acquisition fees. And the most important part is the potential impact of your new loan instalment on your household finances. On the way, we will explain you the next steps and the usual timeline of a loan application processing till the notary deeds.

When is the right time to meet with fidem. ?

Before any real estate project research

If you are thinking about buying a property, it is the right time to familiarize yourself with the realities. What interest rates can I expect? What term and rate fits my goals and desires? How much can I afford? We will answer all these questions before you make your final decision. And it is free of charge and without any obligation.

During your active property scouting

If you are already looking for a new property, it is time to contact us. We will keep you up to date with the latest market developments. We will prepare your loan application so that we can act as soon as you find the right property. With this approach, you do not lose any time on the way to your dream property. We can provide you with a buyer’s certificate, which underlines your financial capacities and gives you an advantage over other prospective buyers.

At the time of your future home sales agreement signature

If not already done at an earlier stage, we will prepare your credit application. We advise you on all relevant points and we assist you throughout the loan application process. We make you aware of how you should structure your loan to remain the most flexible. In doing so, we make sure that you are well informed of any exposure to interest rate risks. We tell you what documents are needed for your individual case to present the loan dossier in the best possible way to the bank and then do what we do best, negotiate your case to obtain the best possible conditions on your behalf.

Buyer Certificate

As already mentioned, fidem. can provide you with a buyer’s certificate in each of the three phases described. This certificate is a real added value in your real estate search or in the purchase price negotiation. The seller can be sure that you have already done the necessary analysis and that your credit file has already been pre-checked. In addition to the time saver for your negotiation, it provides better assurance to the seller and the real estate agent. The seller has now a professional third-party confirmation of your ability to obtain financing from the bank if you sign a preliminary contract. It makes you more prepared and it gives you a head-start on the other potential buyers.

Focusing on your goals and wishes is our philosophy. We adapt the loan to your life, not the other way around. We care that you know the impact of your new loan on your personal finances by that providing you with a transparent overview of your options.

KEY TAKEAWAYS

The most important insights into why you should talk to fidem. about your credit capacity

1

2

3

4

5

6